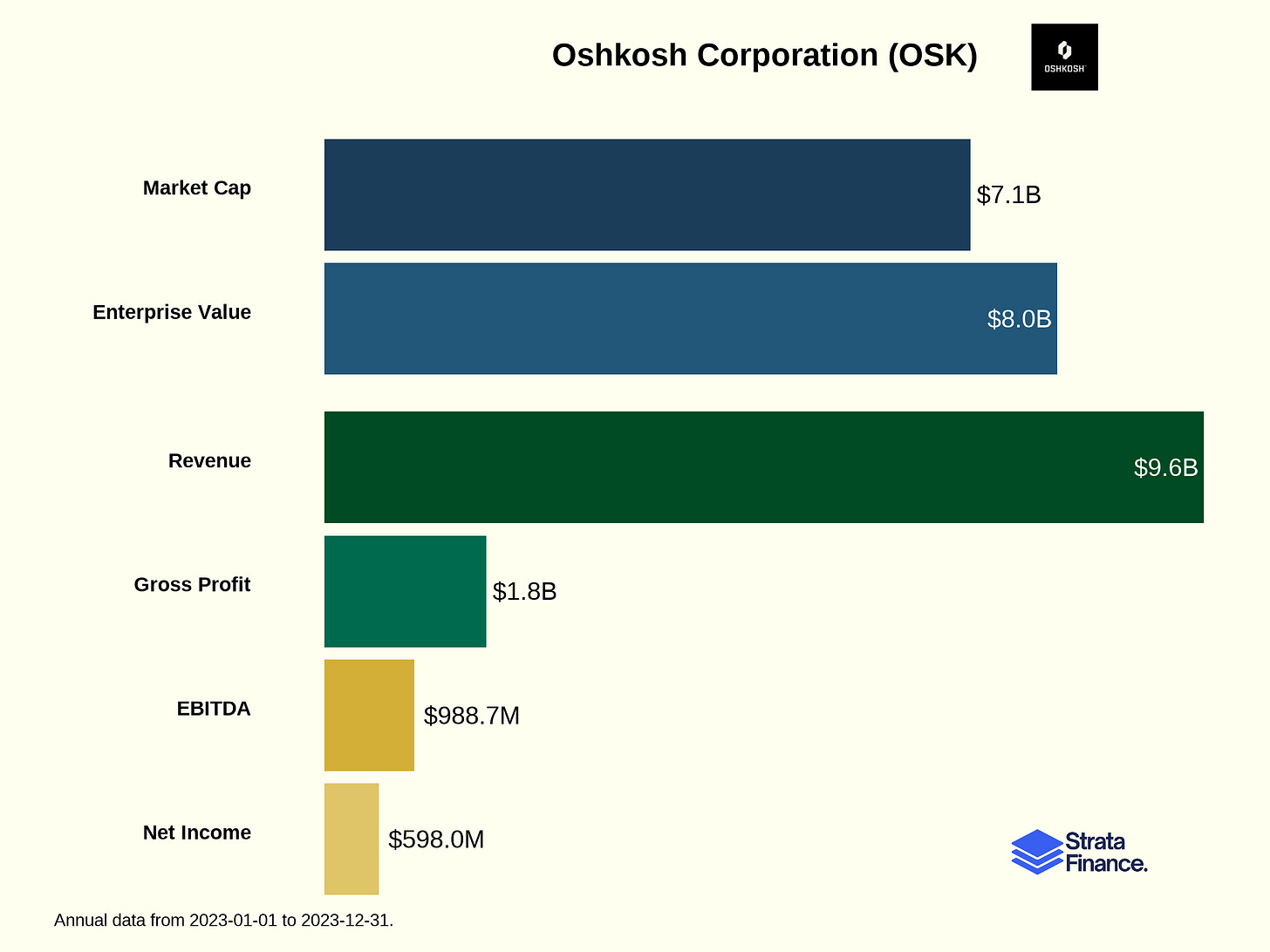

Strata Layers Chart

Understanding the Layers 🔍

All Business Guides have a Layers Chart. This post walks through the different metrics and how to read these charts.

Market Capitalization (Market Cap):

What It Is: Fancy term for “how much the stock market thinks this company is worth.” It’s just the share price multiplied by the number of shares. Simple math, big implications.

Why It Matters: Want to know if you’re dealing with a scrappy underdog 🐶 or a corporate giant 🏢? Market Cap has your back.

Think of it as a company’s price tag, but without the Black Friday discounts.

Enterprise Value (EV):

What It Is: Market Cap’s cooler older sibling. It adds in the company’s debt and subtracts cash to give you the “real” value.

Why It Matters: This is the number you’d care about if you were buying the whole company. It’s like calculating what your dream house costs but also factoring in finding a briefcase of cash in the basement or the pool cleaning bills and HOA fees. 🏡

Pro tip: If EV is way higher than Market Cap, there might be a debt problem lurking. Much smaller means the company is sitting on loads of cash.

Revenue:

What It Is: All the money rolling in from selling stuff before anyone takes their cut. Think of it as the company’s “top line” (because it’s literally the first line on the income statement).

Why It Matters: Revenue shows how good a company is at convincing people to part with their hard-earned cash. 🛍️

Pro tip: It’s not about what you make; it’s about what you keep. Keep reading. 👇

Gross Profit:

What It Is: Revenue minus the cost of making or delivering the stuff.

Why It Matters: Gross Profit is like your paycheck after taxes and deductions. If this number isn’t healthy, the company’s running on fumes.

Pro tip: If Revenue is the sizzle, Gross Profit is the steak. 🥩

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

What It Is: It’s a mouthful, but all you need to know is it shows profitability without all the accounting gimmicks.

Why It Matters: EBITDA is a great way to compare how businesses operate without worrying about their tax shelters or depreciation magic.

Pro tip: Think of it as a “no-makeup selfie” for company profits. 📸

Net Income (sometimes called Earnings or Profit):

What It Is: The money left over after everyone takes their share—employees, lenders, Uncle Sam, and probably Karen in accounting.

Why It Matters: Net Income = what’s left for the shareholders (aka you). It’s the “bottom line” for a reason.

Pro tip: Or as I like to call it, the “is this company even worth it?” number. 💡