SoFi: The Financial Super App Transforming Banking 🏦

SoFi has successfully transformed from a student loan refinancing company to a diversified financial services platform with multiple revenue streams.

Latest Earnings Report | About StrataFinance | How to Read the Layers Chart

The Bottom Line Upfront 🎯

SoFi Technologies has successfully evolved from a student loan refinancing company into a comprehensive financial services platform with a national bank charter. Their "Financial Services Productivity Loop" strategy focuses on acquiring customers with one product, then cross-selling additional services to increase lifetime value. With strong member growth (34% YoY), improving profitability, and a diversifying revenue mix, SoFi has positioned itself as a leading fintech innovator. However, they face intense competition from traditional banks and specialized fintechs, along with regulatory and interest rate challenges. Their focus on high-quality borrowers (average FICO: 750) and technological innovation provides competitive advantages, but execution across multiple business lines remains critical to their continued success.

AI-written, human-approved. Read responsibly.

Layer 1: The Business Model 🏛️

From Student Loans to Financial Super App 📱

SoFi (short for Social Finance) started in 2011 with a simple idea: help people refinance their student loans at better rates. Fast forward to today, and they've transformed into what they call a "one-stop shop" for all things money. Think of SoFi as the financial equivalent of a Swiss Army knife – what began as a single tool has evolved into a multi-functional platform that handles everything from loans to investments to banking.

The company operates through three main segments:

Lending - Still their bread and butter, making up 56% of revenue. They offer personal loans, student loans, and home loans. With an average FICO score of 750 for their borrowers, they're not exactly targeting the "just scraped together enough for a down payment" crowd. SoFi can either hold these loans (earning interest over time) or sell them (for immediate profit). It's like being able to both rent out your house or flip it, depending on what makes more sense at the moment. 💵

Technology Platform - Through acquisitions of companies called Galileo and Technisys, SoFi provides the behind-the-scenes tech that powers financial services. Think of this as selling shovels during a gold rush – they're enabling 168 million accounts (↗️ 15% year-over-year) for other financial companies. This segment contributes 15% of total revenue. 🖥️

Financial Services - This is their fastest-growing segment, offering checking/savings accounts (SoFi Money), investment services (SoFi Invest), credit cards, and other financial tools. Contributing 31% of revenue, this segment went from losing money to generating $307 million in profit in just one year. Not too shabby! 🏦

The Secret Sauce: Financial Services Productivity Loop ♻️

SoFi's strategy hinges on what they call the "Financial Services Productivity Loop" – a fancy way of saying "get 'em in the door with one product, then sell them more stuff." It works like this:

Customer comes to SoFi for a specific need (like refinancing student loans)

SoFi wows them with great service and competitive rates

Customer thinks, "Hey, these folks are pretty good!" and signs up for a checking account

Before you know it, they're investing through SoFi Invest and using a SoFi credit card

Each additional product increases the customer's lifetime value while spreading out the initial acquisition cost. It's like convincing someone to buy a gym membership and then selling them personal training, protein shakes, and branded workout gear – except with less sweating and more compound interest.

Key Metrics They Watch 👀

SoFi obsesses over:

Total members: 10.1 million as of December 2024 (↗️ 34% year-over-year)

Products per member: 14.7 million total products (↗️ 32%)

Deposit growth: $26 billion (↗️ from $18.6 billion in 2023)

Net interest margin: 5.80% (↘️ slightly from 5.88% in 2023)

Layer 2: Category Position 🏆

The Fintech Hunger Games 🏹

SoFi competes in the financial services industry, which is about as crowded as a subway car during rush hour. They're battling on multiple fronts:

Traditional banks (think Chase, Bank of America) with their massive resources and established customer bases

Online lenders like LendingClub and Upstart in the personal loan space

Neobanks like Chime and Revolut for digital banking services

Investment platforms like Robinhood and Public for the brokerage business

Banking-as-a-service providers competing with their Technology Platform

So how does SoFi stand out in this financial mosh pit? They focus on four differentiators:

Speed - They aim to be the fastest place to complete financial transactions (because nobody has ever said, "I wish this loan application took longer to process") ⚡

Selection - Offering a broad range of products under one roof 🛒

Content - Providing financial education and insights (because confused customers don't buy stuff) 📚

Convenience - Making everything easy to use with responsive customer service 🛋️

The Bank Charter Power-Up 🔋

In 2022, SoFi acquired Golden Pacific Bancorp, which gave them something incredibly valuable: a national bank charter. This wasn't just a fancy certificate to hang on the wall – it fundamentally changed their business model. With a bank charter, SoFi can:

Offer FDIC-insured deposit accounts (people tend to like knowing their money won't vanish)

Access cheaper funding for their lending activities (paying 4% on deposits beats paying 7% to other funding sources)

Hold loans on their balance sheet longer to earn more interest

This move was like upgrading from a food truck to a restaurant with permanent real estate – same food, but lower costs and more customer confidence.

Layer 3: Show Me The Money! 📈

Revenue Breakdown: Diversification in Action 🌈

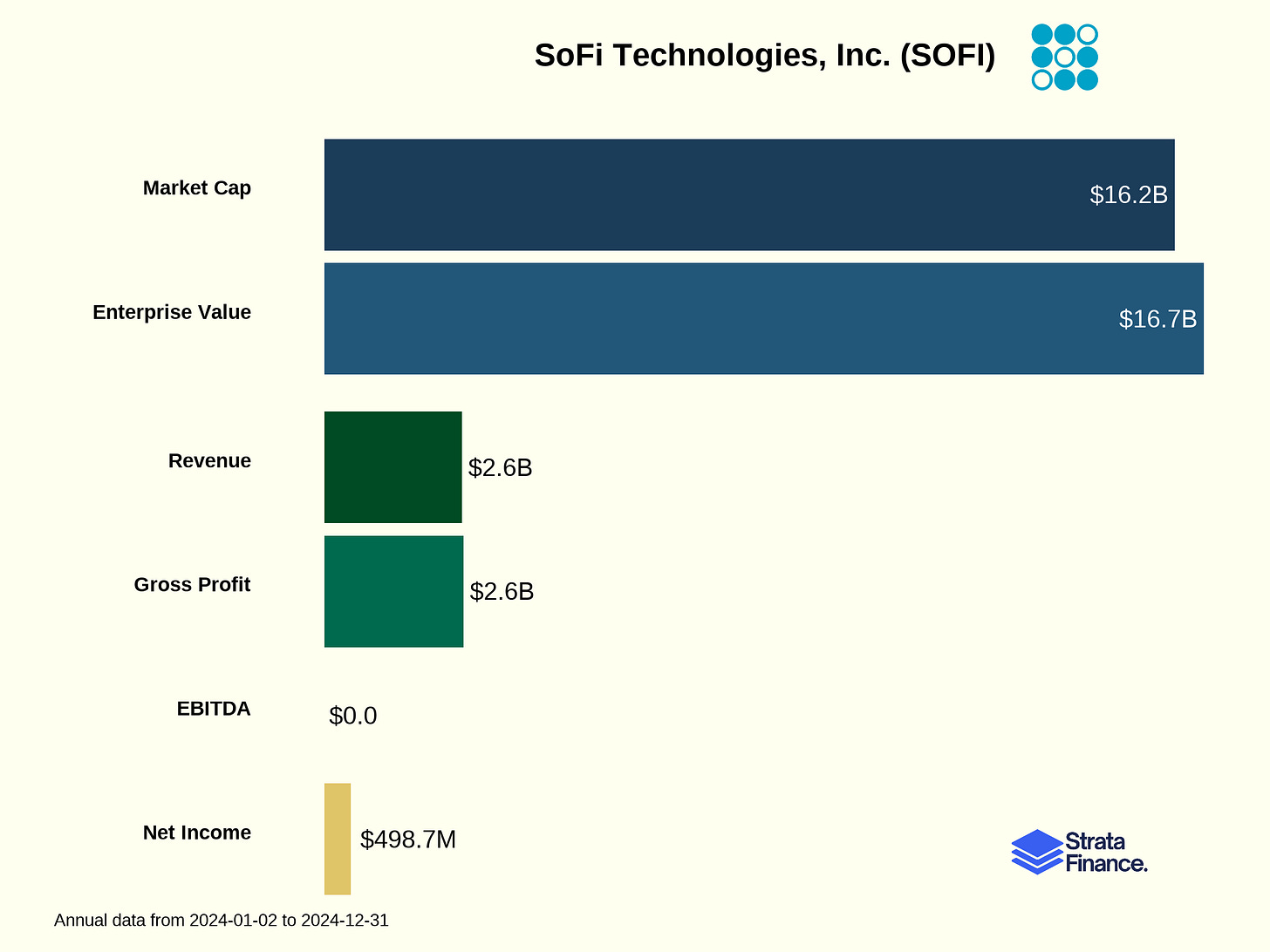

SoFi's total revenue hit $2.7 billion in 2024 (↗️ 26% from 2023), with an interesting shift happening in their revenue mix:

Lending: $1.5 billion (↗️ 8.4% YoY), but decreasing as a percentage of total revenue (56% in 2024 vs. 65% in 2023)

Technology Platform: $395 million (↗️ 12% YoY), holding steady at about 15% of revenue

Financial Services: $822 million (↗️ 88% YoY!), increasing to 31% of revenue from 21% in 2023

This diversification is like a farmer who started with just corn, added soybeans, and is now growing a variety of crops – it makes the business more resilient to changes in any single market.

The Deposit-Fueled Growth Engine 🚂

One of the most impressive aspects of SoFi's business is how they've leveraged their bank charter to grow deposits, which reached $26 billion by the end of 2024. These deposits serve as low-cost funding for their lending activities, improving their net interest margin.

Think of it this way: if SoFi were a restaurant, they used to buy ingredients from expensive suppliers (warehouse financing). Now, they're growing many ingredients in their own garden (customer deposits), dramatically reducing their costs.

Customer Demographics: The Financially Savvy Set 🧠

SoFi isn't targeting just anyone – their average customer has a FICO score of 750, which puts them squarely in the "financially responsible" category. These aren't folks living paycheck to paycheck; they're professionals with good incomes looking to optimize their finances.

This focus on high-quality borrowers means lower default rates but also means SoFi competes for some of the most sought-after customers in financial services. It's like a dating app that only wants to match doctors, lawyers, and successful entrepreneurs – a smaller pool, but potentially more profitable relationships.

Layer 4: Cash Rules Everything Around Me 💰

From Red to Black: The Profitability Journey 📊

2024 was a milestone year for SoFi – they achieved profitability on an annual basis for the first time, with diluted earnings per share of $0.39 (↗️ from a loss of $0.36 in 2023). Their adjusted EBITDA reached $666 million (↗️ 54% from 2023), with margins improving to 26% (↗️ from 21%).

This profitability breakthrough is like a startup restaurant finally covering not just food costs but also rent, staff, and still having money left over – a critical milestone in any business's life.

Cost Structure: Investing While Improving Efficiency 🏗️

SoFi's major expenses include:

Technology and product development: $552 million in 2024

Sales and marketing: $796 million (their largest expense category)

Cost of operations: $462 million

General and administrative: $600 million

While these numbers are substantial, SoFi is showing improving efficiency. Their Financial Services segment went from basically breaking even to generating $307 million in contribution profit in just one year. That's like a side hustle suddenly becoming your main source of income.

The Deposit Advantage 💲

SoFi's bank charter has given them a significant cost advantage. Their average cost of interest-bearing liabilities decreased by 17 basis points in 2024, while their interest-earning assets increased by 38%. This widening gap between what they earn and what they pay is the financial equivalent of buying wholesale and selling retail – the bigger the spread, the better the profits.

With $26 billion in deposits, SoFi has built a stable, relatively low-cost funding base that should continue to support their lending activities and improve their profitability over time.

Layer 5: What Do We Have to Believe? 📚

The Bull Case: Financial Super App Dominance 🐂

For SoFi to truly succeed long-term, investors need to believe:

The Financial Services Productivity Loop works - Members will continue adopting multiple products, increasing lifetime value while reducing acquisition costs.

Bank charter benefits will compound - The advantages of cheaper funding and regulatory flexibility will continue to improve margins.

Technology Platform can scale - The Galileo and Technisys acquisitions will continue growing and providing stable, high-margin revenue.

Product innovation will continue - SoFi will stay ahead of competitors with new features and services that keep members engaged.

Member growth remains strong - The 34% year-over-year growth in members isn't a temporary spike but part of a long-term trend.

The Bear Case: Competitive and Regulatory Challenges 🐻

The skeptics would point to:

Intense competition - SoFi operates in highly competitive markets where big banks and specialized fintechs are constantly innovating.

Regulatory scrutiny - As a bank holding company, SoFi faces increased regulatory oversight that could limit growth or increase compliance costs.

Interest rate sensitivity - Changes in interest rates could squeeze margins or reduce demand for loans.

Cybersecurity risks - As a digital-first financial platform, any major security breach could severely damage customer trust.

Execution challenges - Managing growth across multiple business lines while maintaining quality could prove difficult.

Key Metrics to Watch 🔍

If you're considering investing in SoFi, keep an eye on:

Member growth rate - Any slowdown could indicate market saturation or competitive pressures

Products per member - The core of their productivity loop strategy

Deposit growth - Critical for maintaining their funding advantage

Technology Platform client accounts - Indicates the health of their B2B business

Credit quality metrics - Any deterioration could signal problems in their lending business

The Verdict: Promising But Not Without Risks 🎯

SoFi has successfully transformed from a student loan refinancing company to a diversified financial services platform with multiple revenue streams. Their achievement of profitability in 2024 marks a significant milestone, and their strategy of cross-selling products to increase customer lifetime value makes logical sense.

The bank charter acquisition was a game-changer, providing cheaper funding and regulatory flexibility that should continue to benefit the company for years to come.

However, SoFi operates in highly competitive markets where established players have deep pockets and strong customer relationships. Their success will depend on continued execution across multiple business lines while maintaining high service levels and innovative product offerings.

For investors, SoFi represents an interesting opportunity to bet on the continued digitization of financial services and the potential of the "financial super app" model. Just remember that in fintech, as in Vegas, the house doesn't always win – but SoFi seems to be playing its cards pretty well so far.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.