PayPal: Digital Wallet Pioneer at a Crossroads 💳

Can PayPal evolve from a growth story to a value story while still finding pockets of innovation and expansion?

SEC Earnings Report | About StrataFinance | How to Read the Layers Chart

AI-written, human-approved. Read responsibly.

The Bottom Line Upfront 🎯

PayPal remains a digital payments powerhouse, with 434 million active accounts processing $1.68 trillion annually. Despite solid financials and strong brand recognition, the company faces slowing user growth, intense competition, and margin pressure. Under new CEO Alex Chriss, PayPal is pivoting from "growth at any cost" to "profitable growth." The key question is whether PayPal can successfully transition from a growth story to a value story while still finding opportunities for innovation and expansion in the evolving payments landscape.

Layer 1: The Business Model 🏛️

What Does PayPal Actually Do? 💸

At its core, PayPal is the digital equivalent of your wallet, but with superpowers. Imagine if your physical wallet could instantly send money to friends, pay for things online without sharing your credit card details, and even help you buy stuff now but pay later. That's PayPal in a nutshell.

PayPal operates a massive two-sided platform connecting 434 million active accounts across approximately 200 markets. On one side are consumers who want convenient, secure ways to pay; on the other side are merchants who want to get paid easily and grow their businesses. PayPal sits in the middle, taking a small cut of the action.

The PayPal Family of Brands 👨👩👧👦

PayPal isn't just one product—it's a whole ecosystem:

PayPal: The OG digital wallet that lets you pay online without sharing your financial info

Venmo: The social payment app that's become a verb ("Just Venmo me") among U.S. users

Braintree: The behind-the-scenes payment processor that powers many major websites and apps

Xoom: For sending money internationally (because your cousin in another country needs cash too)

Zettle: For in-person payments with those little card readers you see at farmers markets

PayPal Pay Later: Their buy now, pay later solution for when your wallet says "no" but your heart says "yes"

PayPal Working Capital & Business Loan: Financing solutions for merchants who need cash to grow

How They Make Money 🤑

PayPal has two main revenue streams:

Transaction Revenues (90.7% of 2024 revenue): This is the bread and butter—fees charged when money moves through their system. Think of it as a toll booth on the digital payments highway. These include:

Processing fees when merchants accept payments

Fees when you convert currency (that trip to Europe just got a little pricier)

Fees for cross-border transactions

Fees when you want to instantly transfer money to your bank account

Fees when you buy or sell cryptocurrency

Other Value-Added Services (9.3% of 2024 revenue): The side hustles, including:

Interest and fees from loans to consumers and merchants

Interest earned on customer balances (your money sitting in PayPal earns them interest)

Partnership revenue, subscription fees, and referral fees

Key Success Metrics 📊

PayPal obsesses over these numbers:

Total Payment Volume (TPV): The total value of payments processed ($1.68 trillion in 2024 ↗️10%)

Number of Payment Transactions: How many times people click "Pay" (26.3 billion in 2024 ↗️5%)

Active Accounts: Users who've completed a transaction in the past 12 months (434 million ↗️2%)

Transactions Per Active Account: How sticky the platform is (60.6 in 2024 ↗️3%)

Think of these metrics as PayPal's vital signs—they tell you if the business is healthy and growing.

Layer 2: Category Position 🏆

The Digital Payments Hunger Games 🏹

The payments industry is like a never-ending battle royale with new challengers constantly entering the arena. PayPal was an early pioneer, but now everyone wants a piece of the digital payments pie.

Major competitors include:

Traditional Banks: The old guard with their own payment solutions

Card Networks: Visa and Mastercard, the OG payment rails

Tech Giants: Apple Pay, Google Pay, and Amazon Pay (because tech companies never met a market they didn't want to enter)

Fintech Specialists: Block/Square, Stripe, Adyen, and a new startup probably launching as you read this

Buy Now, Pay Later Players: Affirm, Klarna, and others making credit cards nervous

Cryptocurrency Platforms: Coinbase and others riding the crypto wave

PayPal's Competitive Advantages 💪

Despite the crowded field, PayPal has some serious muscles:

Two-sided Network: With 434 million active accounts, PayPal has achieved the payments equivalent of Facebook's network effect. More consumers attract more merchants, which attracts more consumers... you get the idea.

Trust Factor: When you see that PayPal button on a sketchy-looking website, you breathe a sigh of relief. That trust is worth its weight in digital gold.

Regulatory Moat: PayPal has licenses to operate in markets worldwide—a complex, expensive achievement that creates a barrier to entry for newcomers.

Data Advantage: Processing billions of transactions gives PayPal insights that help improve fraud detection and create personalized offerings.

Market Position: Strong but Under Pressure 📉📈

PayPal remains a payments powerhouse, but it's feeling the heat:

TPV grew 10% in 2024, reaching $1.68 trillion—solid growth, but not the explosive numbers of years past

Active accounts grew just 2% to 434 million, suggesting customer acquisition challenges

Transaction revenue growth (7%) lagged behind TPV growth (10%), indicating pricing pressure

The company is particularly strong in e-commerce but faces increasing competition in mobile payments and buy now, pay later services. PayPal's Braintree division competes directly with Stripe and Adyen for large merchant processing, often in a race to the bottom on pricing.

As one analyst put it: "PayPal is like the payments industry's middle-aged dad—still strong and respected, but no longer the coolest kid on the block."

Layer 3: Show Me The Money! 📈

Revenue Breakdown: Where's the Cash Coming From? 💵

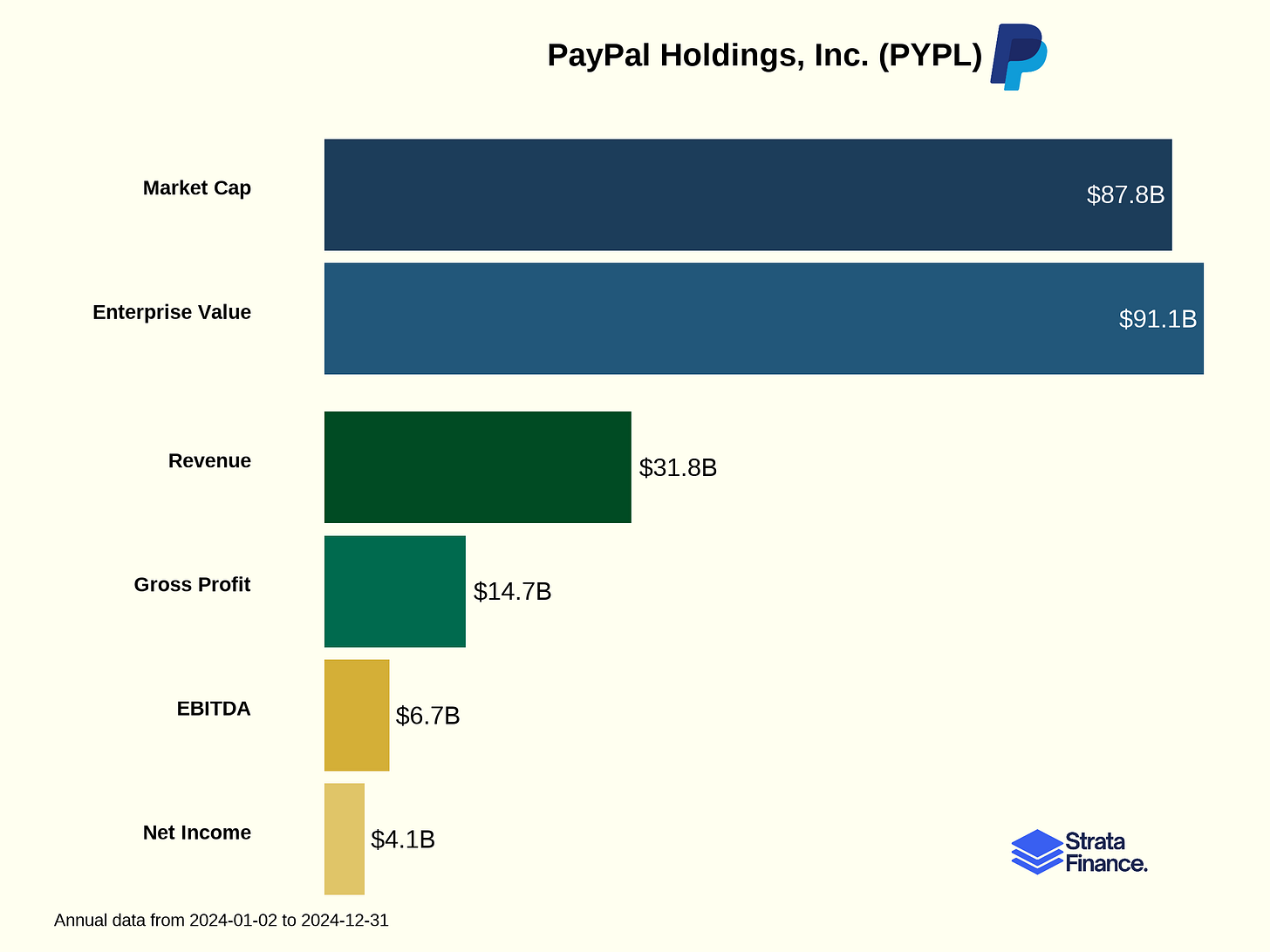

PayPal generated $31.8 billion in revenue in 2024, up 7% from 2023. Let's follow the money:

Transaction Revenues: $28.8 billion (↗️7% from 2023)

Braintree led the charge with a $1.3 billion increase

Core PayPal contributed $0.5 billion in growth

Venmo added $0.2 billion

Other Value-Added Services: $3.0 billion (↗️1% from 2023)

Interest on customer balances jumped $380 million thanks to higher interest rates (thank you, Fed!)

This was mostly offset by a $160 million decline in revenue from their banking partner and $180 million less from various other sources

Geographic Money Map 🗺️

U.S.: $18.3 billion (57% of revenue)

International: $13.5 billion (43% of revenue)

This international exposure is both a strength (diversification) and a challenge (currency fluctuations and regulatory complexity).

Customer Behavior: Show Me the Patterns 🧩

PayPal's customer metrics tell an interesting story:

Active accounts: 434 million (↗️2% from 2023)—growth is slowing

Transactions per active account: 60.6 (↗️3% from 2023)—existing users are using it more

Cross-border TPV: 12% of total TPV (unchanged from 2023)

Translation: PayPal is having trouble attracting new users but is succeeding at getting existing users to transact more often. It's like a restaurant with loyal regulars but struggling to attract new diners.

Growth Drivers and Headwinds 🌬️

What's Pushing Growth:

Increased e-commerce adoption globally

Expansion of buy now, pay later offerings

Growth in Braintree's payment processing business

Higher interest rates boosting revenue from customer balances

What's Holding Them Back:

Intense competition squeezing transaction margins

Slowing user acquisition

Regulatory challenges in multiple markets

Large merchants demanding lower fees

As the company noted in its earnings report: "As a result of ongoing negotiations with merchants, including our stronger focus on profitable growth, we expect lower volume and transaction revenue growth from our Braintree offerings in 2025." Translation: "We're tired of processing payments for peanuts."

Layer 4: Cash Rules Everything Around Me 💰

Profitability Picture: How Much Sticks to the Bottom Line? 📊

PayPal's operating income for 2024 was $5.3 billion (↗️6% from 2023), with an operating margin holding steady at 17%. Net income was $4.1 billion (↘️2% from 2023).

The slight decline in net income despite higher operating income was due to losses on strategic investments in 2024 compared to gains in 2023. Basically, PayPal's investment portfolio had a bad year.

Cost Structure: Where Does the Money Go? 💸

PayPal's biggest expenses:

Transaction expense: $15.7 billion (↗️9%)—the cost of processing payments through banks and card networks

Technology and development: $3.0 billion (flat)—keeping the tech stack running and innovating

Sales and marketing: $2.0 billion (↗️11%)—including the new "PayPal Everywhere" campaign

General and administrative: $2.1 billion (↗️4%)—the corporate overhead

Good news: Transaction and credit losses decreased 14% to $1.4 billion, showing improved risk management.

Credit Portfolio: Playing Banker 🏦

PayPal has a significant lending business:

Consumer loans: $5.4 billion (↗️13% from 2023)

Merchant loans: $1.5 billion (↗️23% from 2023)

The credit quality improved substantially:

Consumer loan net charge-off rate: 4.5% (↘️from 7.2% in 2023)

Merchant loan net charge-off rate: 5.3% (↘️from 18.8% in 2023)

That merchant loan charge-off improvement is particularly impressive—from nearly 1 in 5 loans going bad to just 1 in 20. PayPal seems to have figured out who not to lend to!

Capital Allocation: What Are They Doing With All That Cash? 🏧

PayPal ended 2024 with $13.8 billion in cash and investments. Here's how they're using their money:

Share Repurchases: Spent $6.0 billion buying back 92 million shares in 2024

Debt Management: Maintaining $10.6 billion in fixed-rate debt

Capital Expenditures: $683 million, mostly on technology infrastructure

Credit Facilities: Maintaining a $5.0 billion revolving credit facility (undrawn)

The aggressive share repurchases show management's belief that the stock is undervalued. It's like PayPal saying, "If the market won't appreciate our stock, we'll buy it ourselves!"

Layer 5: What Do We Have to Believe? 📚

The Bull Case: PayPal To The Moon! 🚀

For PayPal to thrive long-term, you need to believe:

The digital payments pie will keep growing: As cash continues its decline, digital payment volumes should expand, lifting all boats including PayPal's.

PayPal can maintain its competitive edge: Despite increasing competition, PayPal's trusted brand and two-sided network create a moat that's difficult to cross.

The company can monetize its massive user base better: With 434 million active accounts, even small increases in engagement or new product adoption could drive significant growth.

Credit quality will remain strong: PayPal's improved risk management in lending will continue, keeping credit losses in check.

The Braintree business can find profitability: Despite pressure on margins, PayPal can find ways to make its payment processing business more profitable.

The Bear Case: PayPal Problems 🐻

The pessimistic view requires believing:

Competition will continue to intensify: Banks, tech giants, and specialized fintechs will keep chipping away at PayPal's market share and margins.

User growth has permanently stalled: The 2% growth in active accounts signals market saturation, and PayPal will struggle to find new users.

Regulatory burdens will increase: As a global financial services company, PayPal faces a complex and constantly changing regulatory landscape that could increase costs and restrict operations.

Technological disruption will accelerate: New payment technologies (like blockchain-based systems) could make PayPal's model obsolete.

Credit risks will return: In an economic downturn, PayPal's loan portfolio could deteriorate rapidly.

Key Metrics to Watch 👀

If you're considering investing in PayPal, keep an eye on:

TPV Growth: The fundamental driver of transaction revenue

Take Rate: Transaction revenue divided by TPV (shows pricing power)

Active Account Growth: Are they still attracting new users?

Transactions Per Active Account: Are users engaging more?

Credit Performance: Charge-off rates and loan loss provisions

Operating Margin: Can they grow revenue faster than expenses?

The Bottom Line: Solid Business at a Crossroads 🛣️

PayPal remains a financial technology powerhouse with impressive scale, strong brands, and solid financials. The company processes an astonishing $1.68 trillion in payment volume annually and maintains healthy margins in a competitive industry.

However, PayPal is at an inflection point. User growth is slowing, competition is intensifying, and the company must find new ways to drive engagement and monetization from its existing user base. The new management team under CEO Alex Chriss is focused on "profitable growth" rather than growth at any cost—a sensible but challenging pivot.

For investors, PayPal represents a established player in the digital payments revolution trading at a relatively modest valuation compared to its fintech peers. The company generates substantial cash flow and is aggressively buying back shares, suggesting management sees value at current prices.

The key question: Can PayPal evolve from a growth story to a value story while still finding pockets of innovation and expansion? The answer will determine whether this payments pioneer remains a leader or becomes just another financial services company.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.