CAVA Group (CAVA): The Mediterranean Fast-Casual Powerhouse Taking America by Storm 🫒🌯

This small restaurant started in DC and now has over 300 restaurants across the country. Will they become the next Chipotle, or just another restaurant chain that peaked too soon?

Earnings Report URL | About StrataFinance | How to Read the Layers Chart

AI-written, human-approved. Read responsibly.

The Bottom Line Upfront 🎯

CAVA is riding high with explosive growth (17.9% same-store sales growth ↗️), rapidly expanding from 237 to 309 restaurants in 2023, and finally turning profitable with $13.3 million in net income after years of losses. Their Mediterranean fast-casual concept is winning with health-conscious consumers, and they’ve successfully completed their Zoes Kitchen conversion strategy. With ambitious plans to reach 1,000+ locations by 2032 and improving restaurant-level profit margins (24.8% ↗️), CAVA is positioning itself as the “Chipotle of Mediterranean food.” However, they face intense competition, potential growth challenges as they expand to new markets, and the question of whether they can maintain their momentum without the benefit of Zoes Kitchen conversions.

Layer 1: The Business Model 🏛️

CAVA Group, Inc. is a fast-casual Mediterranean restaurant chain that’s bringing hummus and harissa to the masses. Founded in 2011 in Bethesda, Maryland, CAVA has grown to 309 restaurants across 24 states and Washington, D.C. as of December 31, 2023. Their mission? “To Bring Heart, Health, And Humanity To Food.” Sounds noble, right? But what they’re really doing is slinging delicious Mediterranean bowls and pitas to hungry Americans who want something healthier than a burger but still crave bold flavors.

The genius of CAVA’s business model is its customization. They offer 38 ingredients that can make over 17.4 billion combinations (yes, billion with a “b”). This means whether you’re a carnivore, vegan, keto-follower, or gluten-free fanatic, CAVA’s got you covered. It’s like the Mediterranean answer to Chipotle’s build-your-own concept but with falafel instead of barbacoa.

CAVA’s restaurants are designed for efficiency and flexibility, typically spanning 2,000-3,000 square feet with seating for 35-55 guests. Each location features walk-the-line ordering (again, very Chipotle-esque) and digital pick-up capabilities. They’ve also started rolling out drive-thru pick-up at 30 locations because Americans love eating in their cars almost as much as they love complaining about gas prices.

Beyond restaurants, CAVA has a Consumer Packaged Goods (CPG) business selling their dips, spreads, and dressings in grocery stores. They produce these items in their 30,000-square-foot facility in Maryland and recently opened a shiny new 55,000-square-foot facility in Virginia. These production centers are expected to support at least 750 restaurants plus the CPG business, so they’re clearly planning for massive growth.

CAVA obsessively tracks several key performance metrics:

Same Restaurant Sales Growth: 17.9% in 2023 ↗️ (that’s hot!)

Average Unit Volume (AUV): $2,639 in 2023 ↗️

Restaurant-Level Profit Margin: 24.8% in 2023 ↗️

Net New Restaurant Openings: 72 in 2023

Digital Revenue Mix: 36.0% in 2023 ↗️

The company has built a vertically integrated supply chain with more than 50 trusted partners, giving them control over quality and consistency. This farm-to-table-to-mouth approach helps them maintain their Mediterranean street cred while scaling rapidly.

Layer 2: Category Position 🏆

CAVA is swimming in a sea of restaurant competition, particularly in the crowded fast-casual dining category. They’re going head-to-head with everyone from Chipotle and Sweetgreen to Panera and Shake Shack, plus countless regional and local players. And let’s not forget the traditional fast-food giants who are always looking to steal market share from up-and-comers.

But CAVA has carved out a distinctive position by focusing on Mediterranean cuisine, which hits the sweet spot of several consumer trends:

Growing interest in authentic, ethnic cuisines

Increased focus on health and wellness

Demand for quality and convenience in the same package

This positioning has helped CAVA appeal to a broad demographic swath - they attract both men and women, span age groups (with particular strength among Millennials and Gen Z), and reach consumers across all income brackets. It’s like they’ve created the Switzerland of fast-casual dining - neutral territory where everyone can find something they like.

CAVA’s acquisition of Zoes Kitchen in 2018 was a strategic masterstroke that accelerated their expansion. They converted 153 Zoes Kitchen locations to CAVA restaurants, with the final conversion completed in October 2023. This allowed them to rapidly expand their footprint without the typical headaches of finding new real estate and building from scratch. It’s like they found a cheat code for restaurant expansion. The company believes they’re just getting started, with plans to grow to more than 1,000 CAVA restaurants in the United States by 2032.

In the Mediterranean fast-casual niche, CAVA is clearly establishing itself as the dominant player. While there are other Mediterranean chains like Garbanzo and The Halal Guys, none have achieved CAVA’s scale or growth rate. They’re essentially creating the category as they go, similar to how Chipotle defined fast-casual Mexican.

Layer 3: The Top Line 📈

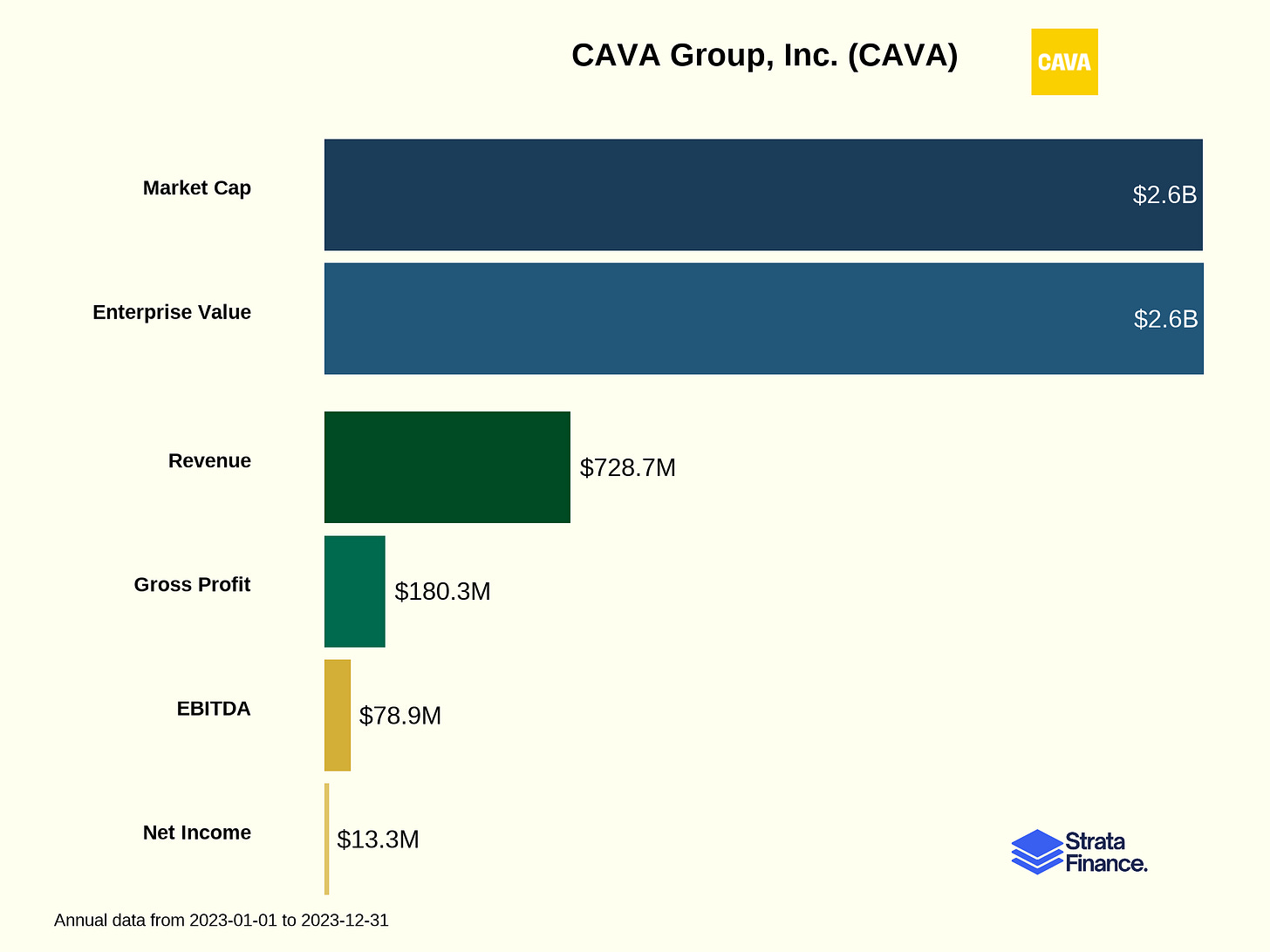

CAVA’s revenue is growing faster than a zucchini plant in summer. Total revenue jumped from $564.1 million in fiscal 2022 to $728.7 million in fiscal 2023, representing a 29.2% increase ↗️. The CAVA segment specifically saw revenue skyrocket from $448.6 million to $717.1 million, a whopping 59.8% increase ↗️. That’s the kind of growth that makes investors do happy dances.

This impressive revenue growth came from two main sources:

New restaurant openings: $177.4 million came from the 145 Net New CAVA Restaurant Openings during or after fiscal 2022, with most of that from the 91 converted Zoes Kitchen locations.

Same Restaurant Sales Growth: 17.9% ↗️, which breaks down to 10.4% from more guests coming in ↗️ and 7.5% from higher prices and better product mix ↗️.

The fact that guest traffic is up 10.4% ↗️ is particularly impressive. In the restaurant business, getting more people through the door is often harder than raising prices, so this suggests CAVA’s concept is resonating strongly with consumers. People aren’t just trying CAVA once; they’re coming back for more of that creamy hummus and spicy harissa.

CAVA’s Digital Revenue Mix reached 36.0% in 2023 ↗️, up from 34.5% in 2022. This includes orders through the CAVA app, website, third-party delivery services, and digital pick-up. The growing digital penetration shows CAVA is successfully adapting to changing consumer preferences for convenient ordering options. It also typically means higher average order values, as people tend to order more food when they’re not standing in line staring at a menu board.

The company does experience some seasonal fluctuations, with lower revenue in the first and fourth quarters due to colder weather and holiday distractions. However, as they’ve expanded geographically, these seasonal effects have become less pronounced. Turns out people in Florida don’t stop eating Mediterranean food just because it’s December.

CAVA’s CPG business, selling those delicious dips and spreads in grocery stores, generated $7.8 million in revenue in 2023 ↗️, up 9.0% from $7.1 million in 2022. While this is still a small slice of the overall revenue pie, it represents an additional growth avenue and extends the brand beyond restaurant walls. It’s also a smart way to keep the brand top-of-mind between restaurant visits.

Layer 4: Cash is King 👑

After years of red ink, CAVA is finally making money! The company reported net income of $13.3 million in fiscal 2023 ↗️, a dramatic improvement from the $59.0 million loss in fiscal 2022. That’s like going from being deeply underwater to finally coming up for air and finding yourself on a sunny beach.

CAVA’s Restaurant-Level Profit Margin increased to 24.8% in 2023 ↗️, up from 20.3% in 2022. This improvement was driven by several factors:

Food, beverage, and packaging costs decreased from 31.4% to 29.0% of revenue thanks to lower input costs and more guests ordering premium menu items.

Labor costs dropped from 27.0% to 25.9% of revenue, primarily due to sales leverage (spreading fixed labor costs across more revenue).

Occupancy costs fell from 9.1% to 8.1% of revenue again benefiting from that sweet, sweet sales leverage.

The company’s largest expense category is food, beverage, and packaging at $213.5 million in 2023, followed closely by labor at $187.3 million. These two cost categories are the bread and butter (or pita and hummus?) of restaurant economics, and managing them effectively is crucial for profitability.

General and administrative expenses increased from $70.0 million in 2022 to $101.5 million in 2023 ↗️, primarily due to higher performance-based incentive compensation, investments in their Collaboration Center Organization, equity-based compensation related to their IPO, and public company costs. This is typical for a company transitioning from private to public status - suddenly there are a lot more hands out for a piece of the pie.

CAVA’s Adjusted EBITDA (a non-GAAP measure that excludes various non-cash and one-time items) soared from $12.6 million in 2022 to $73.8 million in 2023 ↗️, with Adjusted EBITDA Margin improving from 2.2% to 10.1% ↗️. This suggests the underlying business is becoming more profitable as it scales.

The company completed its IPO in June 2023, raising $336.1 million in net proceeds. This cash infusion significantly strengthened CAVA’s balance sheet, with cash and cash equivalents increasing from $39.1 million to $332.4 million ↗️ as of December 31, 2023. That’s a lot of dough (and not just the kind they use for pita).

CAVA also has a credit facility with JPMorgan Chase Bank that provides additional financial flexibility, though they had no outstanding borrowings as of December 31, 2023. With $332.4 million in cash and $98.3 million in available borrowing capacity, CAVA has plenty of financial firepower to fund their ambitious growth plans. They can definitely pay their bills and then some.

Layer 5: By your Powers Combined 💪

Scale Economics ✅

CAVA has built impressive scale economics through its vertically integrated manufacturing and centralized production facilities. Their two production centers (30,000 sq ft in Maryland and 55,000 sq ft in Virginia) can support at least 750 restaurants, allowing them to produce their signature dips and spreads with consistent quality and efficiency. As they continue adding restaurants, fixed costs get spread across more locations, improving overall profitability. It’s like the restaurant equivalent of buying in bulk - the more you make, the cheaper each unit becomes.

Switching Costs ❌

Let’s be honest - switching costs in the restaurant industry are basically non-existent. Customers can easily bounce between CAVA, Chipotle, Sweetgreen, or whatever new concept opened down the street without any meaningful penalty. While CAVA does have a loyalty program, it doesn’t create substantial switching barriers. If someone wants a burger instead of a Mediterranean bowl today, nothing’s stopping them. The restaurant business is notoriously fickle this way.

Cornered Resource ✅

CAVA has developed a cornered resource through its vertically integrated supply chain and direct relationships with more than 50 trusted suppliers. These partnerships, combined with their production facilities and proprietary recipes, give CAVA control over ingredient quality and supply reliability that competitors can’t easily replicate. It’s like they’ve locked up the best Mediterranean ingredients and know-how, forcing others to settle for inferior alternatives or figure it out from scratch.

Counter Positioning ✅

CAVA has established strong counter positioning through its unique combination of Mediterranean cuisine, health-focused options, and fast-casual format. Traditional fast-food chains would struggle to pivot to CAVA’s model without disrupting their existing business, while full-service Mediterranean restaurants can’t match CAVA’s speed and convenience without compromising their current model. It’s like CAVA found the perfect middle ground that established players can’t easily attack without cannibalizing themselves.

Branding ✅

CAVA has built a strong brand centered around Mediterranean cuisine that unites taste and health. Their mission “To Bring Heart, Health, And Humanity To Food” resonates with health-conscious consumers seeking flavorful options. The brand is further strengthened by commitments to quality ingredients, sustainability, and community engagement. The successful extension into grocery stores demonstrates the brand’s strength beyond restaurant walls. They’ve essentially become synonymous with “fast Mediterranean food” in many markets.

Network Effects ❌

CAVA’s business doesn’t exhibit meaningful network effects. One customer’s experience isn’t significantly enhanced by the addition of more customers (in fact, more customers might mean longer lines!). While they benefit from word-of-mouth and social media buzz, these are marketing advantages rather than true network effects. Their digital platform and loyalty program provide convenience but don’t create the kind of interdependent value that increases with user base growth. No matter how many people use the CAVA app, it doesn’t make the app more valuable to you personally.

Process ✅

CAVA has developed strong process power through its operational systems, restaurant design, and digital infrastructure. Their restaurants include efficient ordering systems and separate digital make lines to maximize throughput. The company has invested in robust digital capabilities and a talent development pipeline, including a nationwide training network led by Academy General Managers. These processes create operational efficiency and consistency across locations, giving CAVA an advantage that’s difficult for competitors to match. It’s like they’ve figured out the secret formula for running Mediterranean restaurants at scale.

Layer 6: But you don’t have to take my word for it 📚

The CAVA story is essentially about becoming the “Chipotle of Mediterranean cuisine” - a nationally recognized brand that dominates its category, delivers consistent growth, and generates strong returns for shareholders. But is this Mediterranean dream realistic or just a falafel fantasy?

The Bull Case

CAVA continues its explosive growth trajectory, successfully expanding from 309 restaurants to over 1,000 by 2032. Same-store sales keep climbing as more consumers discover and fall in love with Mediterranean cuisine. Restaurant-level profit margins expand further as scale benefits kick in, and the company generates substantial free cash flow to fund growth and eventually return capital to shareholders. The CPG business becomes a meaningful second growth engine, extending the brand’s reach and creating a flywheel effect with the restaurant business. CAVA has become a household name across America, and early investors are rewarded handsomely.

The Bear Case

CAVA struggles to maintain growth momentum now that the easy wins from Zoes Kitchen conversions are complete. New restaurant openings prove more expensive and less productive than anticipated. Competition intensifies as other chains copy elements of CAVA’s menu and concept. Labor and food costs rise faster than menu prices can be increased, squeezing margins. The company’s expansion into new markets meets resistance from consumers less familiar with Mediterranean cuisine. Growth slows, profitability stalls, and the stock languishes as investors question whether CAVA can truly become a national powerhouse.

What We Have to Believe

To believe in CAVA’s long-term success, you need to believe:

Americans’ appetite for Mediterranean cuisine will continue growing

CAVA can successfully open hundreds of new restaurants in markets where they don’t currently operate

The company can maintain strong same-store sales growth as they mature

Restaurant-level economics will remain attractive despite inflationary pressures

CAVA’s management can execute their ambitious growth strategy without major missteps

Personally, I’ve had mixed experiences at CAVA. Sometimes the food is fresh and delicious, other times it seems like they’re rushing through preparation and skimping on portions. Online reviews suggest I’m not alone - while many customers rave about CAVA’s food and concept, others complain about inconsistency, portion sizes, and value for money. This highlights one of CAVA’s biggest challenges: maintaining quality and consistency as they rapidly scale. It’s one thing to run a few dozen restaurants exceptionally well; it’s quite another to maintain that excellence across hundreds of locations.

The key milestones to watch are new restaurant openings, same-store sales growth, restaurant-level profit margins, and progress toward consistent positive free cash flow. If CAVA can keep hitting these marks quarter after quarter, they might just prove that Mediterranean cuisine can conquer America one hummus bowl at a time.

In the end, CAVA represents an intriguing bet on changing American tastes and the continued growth of fast-casual dining. They’ve shown impressive results so far, but the hardest part of their journey - scaling from a regional success to a national powerhouse without the benefit of acquisitions - still lies ahead. Will they become the next Chipotle, or just another restaurant chain that peaked too soon? Only time (and America’s appetite for tzatziki) will tell.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The information contained in this report has been obtained from sources believed to be reliable, but StrataFinance does not guarantee its accuracy, completeness, or timeliness.